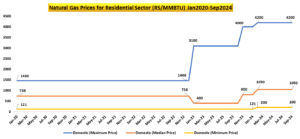

Past five years, residential sectors in the country have faced an alarming rise in natural gas prices, driven by both domestic exploration and production (E&P) and imported liquefied natural gas (LNG). The price hikes, captured in the graph from January 2020 to September 2024, have left many families struggling to manage their monthly energy bills. While natural gas had long been considered an affordable and reliable energy source, recent years have thrown that perception into question.

Source: Oil and Gas Regulatory Authority (OGRA)

At the start of 2020 till 2022 mid, prices were stable, offering a sense of security to residential consumers. But that stability didn’t last. By mid-2022, as indicated in the data that the prices have been climbing rapidly, a trend that has persisted well into 2024, rising from 1,460 rupees per MMBTU to 4,200 rupees per MMBTU for upper slab consumers. This increase also impacts the cross-subsidy for lower slab consumers, making it challenging to sustain if upper slab consumers shift from natural gas to cheaper and renewable alternatives. For some residential sectors, particularly those with higher consumption, this rise has been severe. As illustrated by the trend-line in the graph, likely representing larger users or regions with high demand, the price of natural gas has surged dramatically since late 2022.

So, what’s driving these price hikes, and what does it mean for consumers going forward? The answer, in part, lies in the complex world of LNG, global energy markets, and supply chains.

LNG, has become an essential part of the global energy supply chain. LNG is natural gas that has been transformed to a liquid state for easier storage and transportation. It’s crucial for countries that heavily rely on imports to meet their gas demands. The problem is that LNG prices are notoriously volatile, fluctuating based on geopolitical tensions, supply disruptions, and demand spikes. Since early 2022, global LNG markets have been in turmoil, with prices skyrocketing due to supply shortages.

Several key factors contributed to this. One of the most significant factors remains Russia-Ukraine conflict, which triggered a wave of energy sanctions against Russia, a major exporter of natural gas. Europe, in particular, was forced to look elsewhere for its gas supply, turning to LNG imports. This scramble for alternatives pushed global LNG prices higher, impacting countries that import LNG, including the one reflected in the graph. The higher cost of imported LNG directly translated into higher residential gas prices.

In Asia’s growing energy needs especially from countries like China, Japan, and South Korea have added to the competition for LNG supplies as China and Japan using natural gas as an input for industrial sector. With major industrial and residential consumers in Asia demanding more gas, prices in the global market have been pushed up even further. For residential sector in our country, this means higher costs for the gas that powers heating, cooking, and even electricity in some cases. On top of global factors, the domestic market has its own challenges. Increased urbanization and a growing reliance on natural gas for residential and commercial purposes have led to higher demand locally. With colder winters in recent years and more homes relying on gas for heating, the pressure on supply has only grown. Unfortunately, domestic gas production has struggled to keep up with this increased demand.

Aging infrastructure, delays in new gas field developments, and limited investment in domestic energy sources have all contributed to a situation where supply can no longer meet demand. When combined with the high costs of LNG imports, it’s a recipe for rising prices. The graph shows this clearly: prices stayed relatively flat in the early years of the pandemic when global energy demand was down, but as the world emerged from lockdown and economic activity resumed, demand surged. The result was a steep increase in prices starting in 2022, affecting all residential consumers.

While larger residential sector or regions with higher consumption (represented by the steepest line on the graph) have been hit hardest, even those with more moderate consumption levels (the orange and yellow lines) have seen their bills creep upward. By 2024, it’s clear that no segment of the residential market is insulated from these increases. Europe’s experience during the energy crisis offers a glimpse of what could happen if prices continue to rise. Many European countries were forced to impose emergency measures to shield consumers from the worst of the gas price increases. Governments stepped in with subsidies and price caps, but even these temporary measures have their limits. The UK, for instance, saw energy bills soar by over 80% at one point, forcing the government to intervene with billions of pounds in aid.

The situation in Germany wasn’t much better, where heavy dependence on Russian gas led to fears of winter shortages. Similarly, Japan and South Korea, major LNG importers, have faced rising costs for gas imports. These nations, with their heavy reliance on LNG for electricity generation and heating, experienced price hikes that trickled down to residential sector and businesses alike. Both governments have had to subsidize gas prices heavily to prevent economic fallout.

These global cases serve as a warning if prices in our country continue to rise, we could face similar scenarios where residential sector budgets are stretched thin, and government intervention becomes necessary. As we look ahead to the remainder of 2024 and beyond, the outlook for natural gas prices remains uncertain.

If global LNG prices stay high and domestic supply doesn’t improve, consumers may continue to see rising costs for natural gas. For some residential sector, this could mean cutting back on usage or looking for alternative energy sources like electricity, solar panels, or heat pumps. There’s also a growing call for more investment in renewable energy, which could help reduce dependence on volatile natural gas markets in the future. Solar, wind, and other renewable energy sources offer a more sustainable, stable option for powering homes and businesses. However, the transition to renewables will take time, and in the short term, residential sector will need to brace for potentially higher gas bills. In the end, the surge in natural gas prices reflects a combination of global pressures and domestic challenges. While solutions exist, they will require coordinated efforts from both policymakers and consumers. For now, the best many can do is prepare for higher costs and hope that relief comes sooner rather than later.

Disclaimer: The views and opinions expressed in this article are those of the author and do not necessarily reflect the official policy or position of The Global Dynamic or its editorial team.